The future is looking bright for America’s world-leading, better-for-you food and beverage brands.

The global health and wellness foods market is expected to reach $1 trillion by 2026, with an ever-increasing appetite for all things organic, functional, plant-based, and allergen-friendly. Investors have been taking notice. The number and size of food and beverage IPOs has been rising, while M&A activity is expected to increase. What’s more, the landscape is shaping up to be a seller’s market.

For food and beverage brands, this represents generational opportunities for growth. Those with hopes of their own IPO or big acquisition would do well to ensure they’ve done everything they can to snag the highest valuation possible.

One of the most efficient paths to an increased valuation is exporting. With only 1 in 10 American manufacturers selling overseas, exporting represents an untapped opportunity to grow your bottom line and make it more attractive to suitors. Here are three ways American better-for-you food and beverage companies can increase their valuation through exporting.

Exporting is a force multiplier

Companies that export are 17% more profitable than those that don’t. Why? They are more likely to fully use their production capabilities, and they are reaching more customers. Ninety-five percent of the world’s consumers live outside the U.S. — that’s a ton of opportunity to increase sales velocity and build brand awareness and loyalty.

For larger, more established brands, exporting is an ideal way to maintain aggressive growth rates — no easy task in a crowded marketplace — that will directly impact valuation. Large brands who plateau should look to international sales to expand their sales channel and sustain growth.

Derisk your brand

Many think international sales can be risky. But if anything, exporting derisks brands. A wider geographic reach can protect companies — especially smaller or startup brands — during economic downturns, political unrest, or natural disasters. According to the SBA, small businesses that export are 8.5% less likely to go out of business than non-exporters.

Growth from exporting also enables brands to create new products, further insulating from negative market forces. A more diverse product portfolio also spreads risk between markets and contributes to greater brand awareness and customer loyalty, driving up revenues and valuation.

Own your category

With so few American brands exporting, there is literally a world of opportunity for companies to own their category, or at minimum vastly increase their market share. This opportunity won’t last forever, but for the next decade or two, international should be a major part of your brand strategy to become a category leader. Think about it — it’s much easier to go into a country where your product category is underdeveloped and take over the market, add revenue and retailers. The result will be faster growth en route to an increased valuation.

When you consider that foreign competition is increasing domestically for U.S. brands, companies must consider opening markets abroad to stay competitive at home and on the global stage.

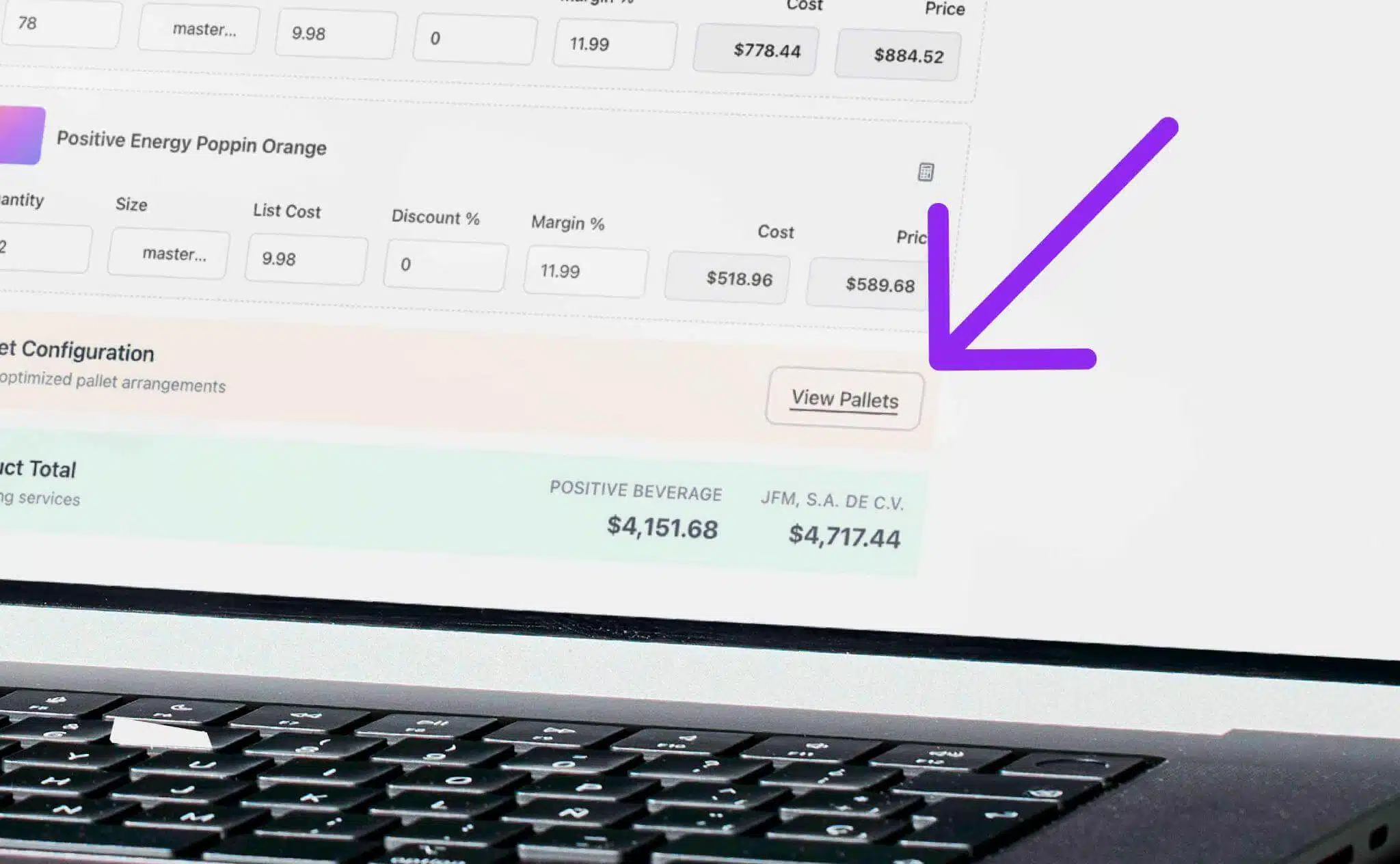

It’s true that exporting is traditionally a complex and fragmented process, but it doesn’t have to be that way. Tools like Grovara’s proprietary platform that streamlines and automates exporting into a seven-click process to transact, enables product discovery, and manages documentation and communication make the journey much easier. This allows brands to concentrate on their core functions while achieving the kind of valuation they deserve as they aim to cash in on the amazing opportunities that await in global wellness.

With Grovara, better-for-you brands are able to focus on domestic sales and leave international to our online marketplace that streamlines and automates the many fragmented steps of exporting in a single platform that takes only seven clicks to complete a transaction.