In October, the United States government issued an RFP for e-marketplace platforms in an effort to become leaner with the $260 million it spent online last year on products and services. The U.S. General Services Administration, which oversees federal procurement, wants to move fast and start implementing proof-of-concept early next year with a handful of federal agencies to fully develop its Commercial Platforms program.

While government and large corporations often drive some of society’s most significant innovations, it is small and medium-sized players who have mostly kept the B2B e-marketplace fire burning over the last decade and a half, and the U.S. government’s entry into the space signals an inferno is forthcoming.

A new study from London fintech consulting firm iBe predicts global B2B e-marketplace sales will rise to $3.6 trillion worldwide and account for nearly one-third of all global online B2B trade in five years, up from $680 billion and 7.5%, respectively, in 2018.

“A new generation of global buyers have grown accustomed to conducting online B2C transactions with ease and confidence, and they are helping create the increased demand for B2B e-marketplaces,” says Grovara CEO Peter Groverman (pictured above). Grovara’s first-of-its kind technology platform for the American wellness industry — a curated B2B e-commerce international marketplace for the most promising U.S. manufacturers of organic and natural specialty foods and beverages – is being rolled out for use by global buyers in more than 45 countries this fall.

As early as 2001, B2B e-marketplaces were being touted as having advantages over traditional marketplaces. Nicholas Bloch and Thierry Catfolis argued in their report in Business Strategy Review that market intelligence and supply chain integration were the biggest advantages.

In 2006, two academics in Portugal released a grant-funded study that determined what factors influenced a positive relationship between buyer and seller in an e-Commerce marketplace (or e-marketplace). Those factors included termination costs, supplier relationship policies and practices, and communication and information exchange. Not surprisingly, pricing and opportunistic behavior negatively impacted the relationship. Relationship commitment and trust play a major role, so the key takeaway here was to “stop thinking like a supplier and start thinking like a customer.”

According to shipping and logistics leader UPS and its Pulse of the Online Shopper survey, nearly half of the 897 business surveyed choose B2B e-marketplaces for shipping efficiency that speed up checkout and provide other perks like saving delivery preference (49%) and payment details (48%) and purchase in one click (49%).

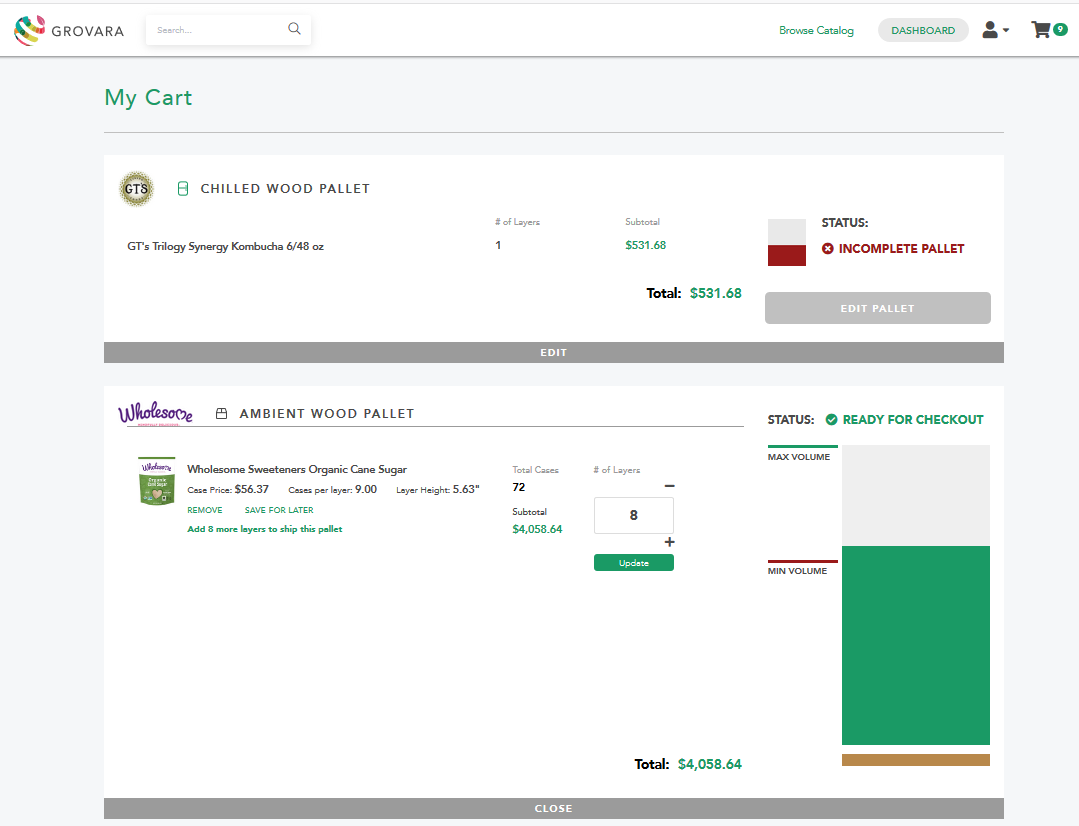

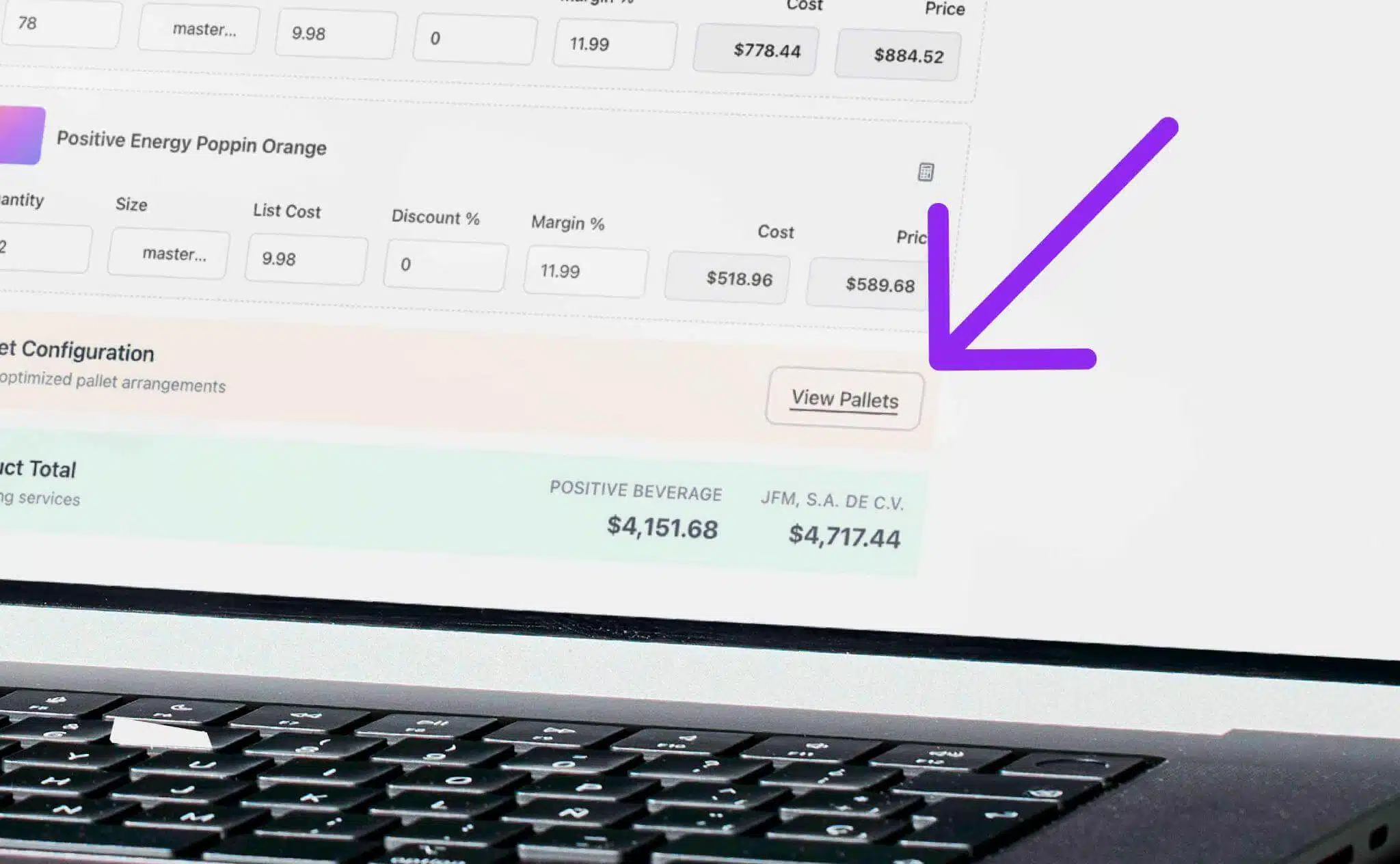

Grovara’s B2B e-commerce international marketplace is powered by data from SPINS (market, company and product statistics and trends) and IX-ONE (product/brand information and labeling info), streamlining and automating the workflows associated with exporting. The proprietary technology platform provides global retailers with a truly modern buying experience and eliminates the headaches of global trade, like fraud risk, documentation and logistics coordination.

So while e-marketplaces have been on the B2B map for almost a generation, it is only now that large corporations and governments are catching on. Grovara is ready for the B2B e-marketplace spree because the company’s first steps back in 2010 were in its future customers’ shoes, trailblazing the globe to share some of America’s best-made products. And creating a product that provides equal benefit for buyer and seller is a big part of why this B2B gold rush has commenced.

A recent report from McKinsey highlights what the growth of B2B e-marketplaces will look like:

“Just as the growth of B2B marketplaces will reshape the procurement function and the role of the CPO (Chief Procurement Officer), so, too, will procurement influence the evolution of marketplaces. We envision CPOs eventually partnering with the marketplace to find goods and services, forming buyers’ consortia among peers, and even developing entire ecosystems with suppliers and peers that more effectively serve companies’ needs.”